As we wrote back in March 2021, after five months of a strong rotation in styles towards “value” stocks and profit-taking on “growth” stocks, the market has once again placed its trust in fundamentals and favoured growth stocks, focusing in particular on innovative businesses with accelerating revenues and profits. Since the end of the summer, valuations in some of these quality/growth areas appeared to look somewhat stretched.

Where are we at?

In terms of interest rates, we do not think that we have yet seen the end of the upward cycle on long-term rates. In the short term, we expect 10-year US and German rates to continue to normalise. We expect this upward trend to persist until early next year. As we also forecast in our previous update, after a period of uncertainty around inflationary risks, which lasted until Spring 2021, market sentiment completely reversed by the end of the Summer 2021. Central bank statements had a calming effect on market participants, who are now appraising the current situation. Inflation remains strong on both sides of the Atlantic and is expected to stay that way for much of 2022. While fewer barriers to international trade look to be in store, we expect higher food inflation featuring among the key indicators for a number of subsequent quarterly updates..

Meanwhile, central banks have returned to tapering their support, which should also help the normalisation of long-term interest rates both in the US and Europe.

Economic growth. Budget deficits, which had led to substantial increases in the level of debt in the US and Europe, highlighted the need for the countries concerned to apply greater financial discipline.

Government assistance is expected to be terminated at an increasingly brisk rate, with regard to both the stimulus measures to boost consumption and subsidies for small and medium size businesses.

Economic growth in the US and Europe is expected to slow at varying rates in 2022 and beyond, as it will continue to be impacted substantially by the COVID-19 crisis, which sent national deficits and debt skyrocketing globally.

Markets are likely to continue to be characterised by low economic growth. In addition, the growth potential of China, which has been the main global growth driver for over a decade, is expected to lose some of its muscle as the country seeks to reduce the financial leverage of its economy.

Given the weak growth potential, we expect long-term interest rates to peak in the first half of 2022. In stock market terms, this will correspond to a pick-up in the performance of quality/growth companies which are able to deliver profitable structural growth amid a slowing market environment.

Markets. Contrary to our observations six months ago, when the market was thoroughly relaxed – and hanging religiously on every word of central banks – the focus of attention now is “inflation”. Central banks themselves are beginning to indicate that inflation could be less temporary than expected.

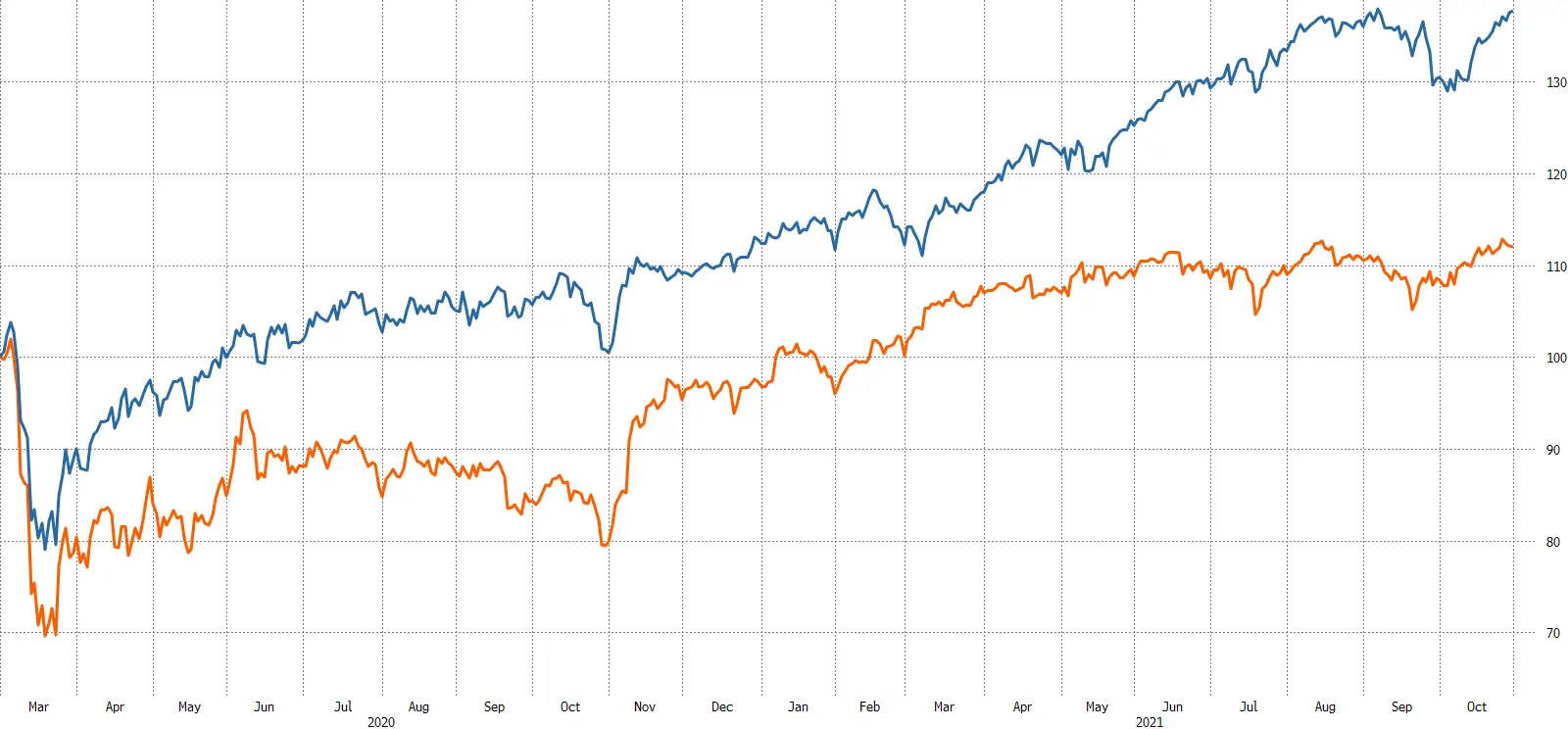

Based on our inhouse style management and valuations model, the valuation premium of growth stocks had disappeared completely around March 2021, following value rotation taking place in the preceding months.

THE MSCI EUROPE VALUE VS GROWTH INDEX SINCE THE START OF THE PANDEMIC:

Source: Bloomberg, performance of the MSCI© Europe Value and MSCI© Europe Growth indices from 28/02/2020 to 29/10/2021.

Our vision for 2022

With the prospect of higher bond yields between now and early 2022, we expect to see a final upward surge in value stocks over the same period. The trend is likely to last until the first quarter of 2022. However, we think it appropriate to capitalise on this less favourable period for growth stocks to “buy low” into businesses set to generate profitable and structural growth over the coming years.

For the value style to demonstrate strong long-term performance, economic growth will need to accelerate considerably, which is not our core scenario for the short to medium term.

Our challenge in 2022 will be to select the companies that are likely to benefit from stronger economic growth owing to their high-potential market segment or to their use of innovation. In Europe, we see a broad range of companies that can offer solutions to numerous accelerating megatrends, such as energy transition, new health technologies, digitalisation, and the automation of the economy.

For a clearer analysis of the graph, it is useful to understand the definition of the “growth” and “value” styles.

- Growth stocks, usually defined by higher profit growth, generally sell at higher valuations. The MSCI© Europe Growth index, designed to represent 50% of the market capitalisation of MSCI© Europe, is defined through the factorial analysis of short- and long-term growth in earnings per share (EPS) and current growth and historical long-term growth in EPS and sales.

- Value stocks are generally defined as having a lower price relative to profits or assets. For the MSCI© Europe Value index, they are defined using a factorial model of book value relative to price, long-term P/E and dividend yields.