The Federal Reserve (Fed) adopted a hawkish stance during its last Federal Open Market Committee (FOMC) of the year on 15 December. The median FOMC member is now ready to start a new interest rate hiking cycle in 2022. However, across the Atlantic, the European Central Bank (ECB) has retained its accommodative policies while the eurozone seemed to move further away from full employment. As things stand now, increases in ECB short-term rates are not expected before mid-2023.

The Fed’s hawkish stance – but do markets care?

Market anticipations point to a somewhat elevated level of both GPD growth and inflation in the first half of 2022. Over the course of the year, we should see a gradual deceleration of growth, unemployment and inflation to be more in line with the longer term central bank objectives.

The doubling of the current pace of the tapering announced yesterday means the first interest rate increase is possible by June, with further hikes taking place later in 2022. Some expectations point to as early as March, given that Fed Chair Powell pointed out that there is no need to have a lag between the end of the tapering and the first interest rate increase. As a result, the Fed median dot level at the end of 2022 now implies three rate hikes next year.

The Fed now looks set on a path of fighting inflation and seem confident that we will have a solid growth backdrop over the next years.

But longer-term views on the end of the interest rate cycle diverge.

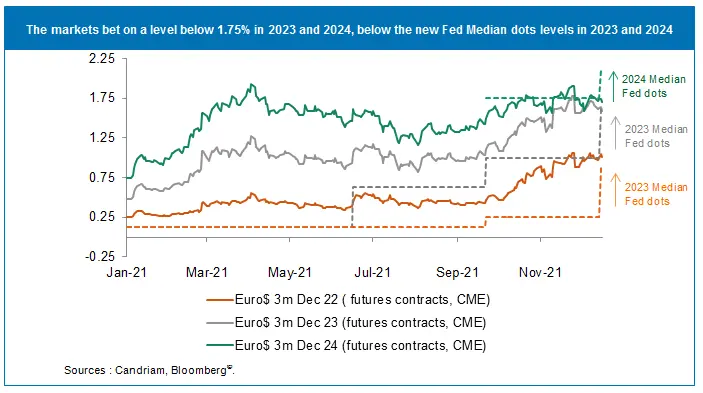

Until 15 December, markets were well in advance of the Fed projections for 2022 and 2023. The central bank validated these anticipations by modifying its dots reflecting the appropriate midpoint of the fed funds rate at the end of 2022.

In the meantime, market rates are now below these levels, notably for 2024. It may mean that either 1) investors are very confident in the Fed’s ability to fight inflation or 2) they believe that growth will slow significantly in 2024.

These moves will be closely monitored to assess the yield curve and the long-term nominal rate level. The median dot levels in December 2023 and 2024 are now clearly above the current 10-year nominal yield.

ECB’s mantra of flexibility

The ECB maintained confidence in its ability to reach the long-term objective of keeping inflation in check. The bank reiterated its forecast for the core CPI at 1.8% in 2023 and 2024, even if the 2022 target has been lifted.

There was a somewhat muted market reaction to these news, which could have been a reflection of a disappointing size of the APP envelope, which was increased by EUR90bn. However, ECB Chair Lagarde reiterated her dovish approach.

The bank seems quite optimistic on growth, notably for 2022 and 2023, and expect it to reach nearly 2% in 2024 in real terms, supported by a strong domestic demand. If it was not for the pandemic, the environment would have been more supportive of inflation and economic growth. For now, the different variants are somewhat hindering growth and inducing inflation.

We believe that the ECB needs to be more flexible in managing its monetary policy to accommodate both the Next Generation European plan and the energy transition.

As was expected, the ECB will end its PEPP program by March 2022. However, its PEPP reinvestments will last until the end of 2024 and the capital rule is expected to be flexible in order to facilitate its monetary transmission, notably in Greece. Moreover, it will add to its APP purchases EUR 20 bn in Q2 and EUR 10 bn in Q3.

Higher inflation for longer… and a bigger lift-off ?

We expect supply and demand to gradually adjust amid an above-potential growth across major developed economies. As strong demand in the face of pandemic-related supply bottlenecks has led to higher prices. We expect inflation to remain uncomfortably elevated, at least in the winter months.

While we expect inflation expectations to peak in 2022, there is likely to be much uncertainty around its trajectory in the first half of 2022. This may test the patience of central banks and bring volatility to fixed income markets and impact equity factors. Economic growth is expected to remain sound over the next year due to fiscal plans globally.

Cross-asset approach: favour over bonds in 2022 but flexibility is key

In this environment, 10-year US Treasury yields are expected to fluctuate between 1.5% and 2.5%, warranting a short duration. This level of volatility is likely to result in the yield curve alternating between steepening and flattening. This will depend on the concerns over inflation and, more importantly, the Federal Reserve Bank’s reaction function. As we mentioned earlier, with the US economy getting closer to full employment, we expect the Fed to conclude its tapering by March 2022 and lift rates over the following months.

The transition of a Fed rate hike cycle is a very delicate time. Therefore, we are neutral on credit as the spreads are very tight and cautious due to a possible increase of long-term yields. However, European credit could benefit from the ECB maintaining a less hawkish stance than its peers. Financial conditions remain relatively loose for the time being, as long-term yields are not increasing significantly. In this environment we are likely to start 2022 favouring equities. We are slightly overweight Europe and China from the region perspective, and overweight banks and commodities from the sector perspective. We retain structural exposures to thematic investment areas such as healthcare, climate action and innovation, particularly technology oriented stocks. Over the coming years, the relationship between productivity and wages will be key. The possible impact of the global pandemic (watch out for new COVID variants) on growth and inflation over the medium-term needs to be closely watched. In the end, it will be the behaviour of the long-term real yields which will be a key factor for equity valuations.